Restez au courant des dernières nouvelles et annonces.

PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Tenir les marchés mondiaux

entre vos mains

Notre application de trading pour mobile est compatible avec la plupart des appareils intelligents. Téléchargez l’application dès maintenant et commencez à trader avec PU Prime sur tout appareil, à tout moment et en tout lieu.

Dear Valued Client,

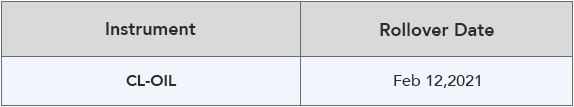

Please be advised that the following CFD instrument will be automatically rolled over as per the date in the table below. As there can be a pricing difference between old and new futures contracts, we recommend clients to monitor their positions closely and manage positions accordingly.

Expiration dates:

*All hours are provided in GMT+2 (Server Time in MT4.)

Please note:

• The rollover will be automatic, and any existing open positions will remain open.

• Positions that are open on the expiration date will be adjusted via a rollover charge or credit to reflect the price difference between the expiring and new contracts.

• To avoid CFD rollovers, clients can choose to close any open CFD positions prior to the expiration date.

• Clients should ensure that take profits and stop losses are adjusted before this rollover occurs.

If you have any questions or require any assistance, please contact our support team via Live Chat, email: [email protected], or phone 400 120 0576.

Dear Valued Client,

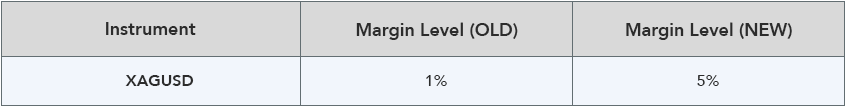

Given the market fluctuations expected to increase silver markets volatility, the well-being and safety of providing a secure trading environment to clients remains the first priority for Pacific Union. We have conducted a review of our risk management policies and decided to raise the margin requirements for Silver (XAGUSD) on MT4 Server Time (GMT+2) 00:00 of 3rd February 2021.

Please refer to the table below outlining the affected instrument:

*All hours are provided in GMT+2 (Server Time in MT4.)

Please be aware that to keep open positions of XAGUSD is required a higher margin requirement during this volatile period, we recommend clients to properly control their positions and trade cautiously.

Pacific Union will endeavor to notify you prior to any of the changes being made. We intend to return to normal margin level shortly and will keep our clients update accordingly.

If you have any questions or require any assistance, please contact our support team via Live Chat, email: [email protected], or phone 400 120 0576.

Dear Valued Client,

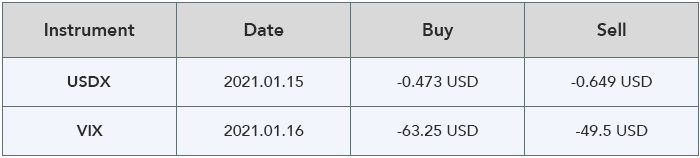

To provide a broader portfolio of products, Pacific Union will permanently switch our US Dollar Index Futures & Volatility Index Futures to US Dollar Index Cash & Volatility Index Cash from 14th January 2021 (USDX) and 15th January 2021 (VIX) respectively. The LAST rollover for USDX will be carried out before the market open on 14th January 2021 and that of VIX will be carried out before the market open on 15th January 2021.

All open positions will be charged overnight financing charges from the date listed in the table below:

Note: All hours are provided in GMT+2 (Server Time in MT4.)

These charges are subject to changes. Please refer to MT4 for details.

To avoid rollover or financing charges, clients may choose to close any open positions of USDX before the market closes on 13th January 2021, and VIX before the market closes on 14th January 2021.

During this product switching period, please carefully evaluate the risks that may arise and trade with caution.

If you have any questions or require any assistance, please contact our support team via Live Chat, email: [email protected], or phone 400 120 0576.

Dear Valued Client,

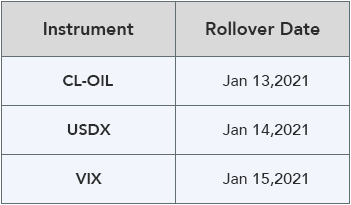

Please be advised that the following CFD instruments will be automatically rolled over as per the dates in the table below. As there can be a pricing difference between old and new futures contracts, we recommend clients to monitor their positions closely and manage positions accordingly.

Expiration dates:

*All hours are provided in GMT+2 (Server Time in MT4.)

Please note:

• The rollover will be automatic, and any existing open positions will remain open.

• Positions that are open on the expiration date will be adjusted via a rollover charge or credit to reflect the price difference between the expiring and new contracts.

• To avoid CFD rollovers, clients can choose to close any open CFD positions prior to the expiration date.

• Clients should ensure that take profits and stop losses are adjusted before this rollover occurs.

If you have any questions or require any assistance, please contact our support team via Live Chat, email: [email protected], or phone 400 120 0576.

Dear Valued Client,

Please be advised that the Demo Server upgrade is completed and Demo Account Opening Application is resumed accordingly. Meanwhile, MT4 Demo Server is renamed from PacificUnion-Demo to PacificUnionInt-Demo, you could re-login with the following 2 method:

1. MT4 for Mobile

• Launch the MT4 app and select “Setting”–“New Account”–“Login to an existing account” to search the new demo server to login.

• If clients can’t find the new demo server, please uninstall the old version and reinstall the new version of the MT4 platform from Google Play Store, App Store or our official website: https://puprimecomsta.wpengine.com/trading-platform/metatrader4/

2. MT4 for PC

• Launch the MT4 trading platform and select “File”–“Login to trade account” to login with new demo server

• If clients can’t find the new demo server, please uninstall and download the latest version of MT4 trading platform from our official website: https://puprimecomsta.wpengine.com/trading-platform/metatrader4/ , please kindly search the new demo server to login with your account details afterwards.

If you forget the MT4 Demo Account password, you could try to retrieve it from registered email or re-apply a new Demo Account on website: https://puprimecomsta.wpengine.com/open-demo-account/

*Please note that the Demo Account opened during 14th to 20th December 2020 that will be invalid after the upgrade. You need to re-apply a new one. We apologize for any inconvenience caused.

If you have any questions or require any assistance, please contact our support team via Live Chat, email: [email protected], or phone 400 120 0576.